Pocket Option Predictions: An In-Depth Analysis for Successful Trading

In today’s dynamic trading environment, making accurate Pocket Option predictions https://pocketoption-online.com/prognozi-pocket-option/ is paramount for achieving financial success. Traders need to develop a thorough understanding of market trends, indicators, and trading strategies. In this article, we will delve into various factors that influence Pocket Option predictions, tips for effective trading, and how to utilize technical analysis to enhance your decision-making process.

Understanding Pocket Option

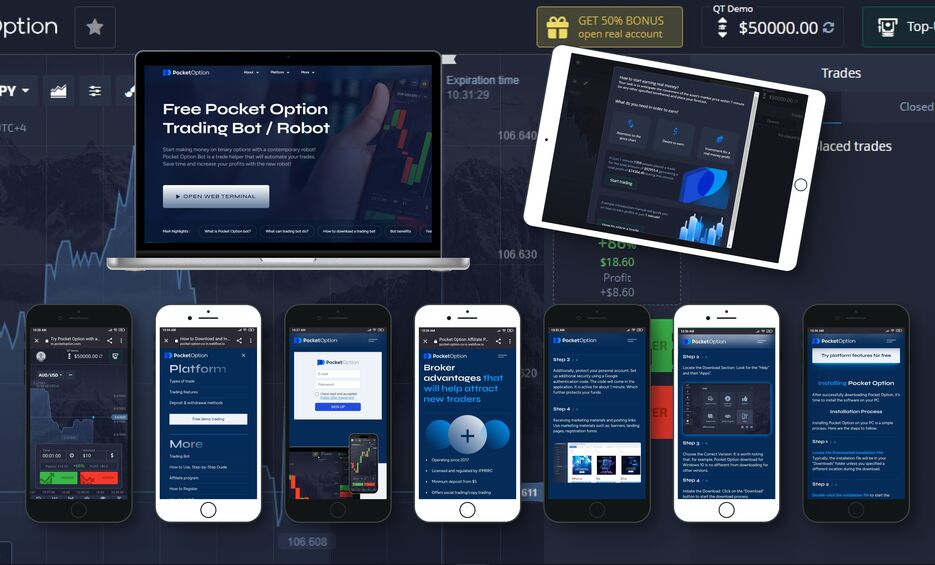

Pocket Option is a prominent trading platform that allows users to trade various assets, including forex, cryptocurrencies, and stocks. Its user-friendly interface and a myriad of trading tools make it an attractive option for both novice and experienced traders. The platform’s unique features, such as social trading, allow users to follow other traders and implement similar strategies, enhancing their chances of making profitable trades.

The Importance of Accurate Predictions

Accurate predictions are crucial in the trading world. They enable traders to foresee market movements, make informed decisions, and manage risks effectively. In the context of Pocket Option, predictions often involve understanding the price action of assets based on historical data, patterns, and economic indicators. Correct predictions can lead to successful trades and substantial returns on investment.

Key Factors Influencing Predictions

Several factors can influence Pocket Option predictions:

- Market Trends: Observing market trends can provide insights into potential price movements.

- Economic Indicators: Data such as employment rates, GDP growth, and inflation can significantly impact asset prices.

- Technical Analysis: Utilizing charts and indicators like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands can help traders identify entry and exit points.

- News and Events: Awareness of geopolitical events, economic releases, and industry news can help traders make educated predictions.

Technical Analysis for Pocket Option Predictions

Technical analysis is an essential tool for making accurate predictions on Pocket Option. By analyzing price charts and using various indicators, traders can gauge market sentiment and identify potential price movements. Here are some popular technical analysis tools:

1. Moving Averages

Moving averages smooth out price data to identify trends over a specific period. Traders often use the 50-day and 200-day moving averages to determine bullish or bearish trends.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps identify overbought or oversold conditions.

3. Bollinger Bands

Bollinger Bands consist of a middle band (simple moving average) and two outer bands (standard deviations). They help identify volatility and potential price reversals.

Strategizing Your Trades

A well-thought-out trading strategy is vital for making informed Pocket Option predictions. Here are a few strategies that traders can adopt:

1. Trend Following

This strategy involves identifying and following the prevailing market trend. Traders enter positions in the direction of the trend, aiming to capitalize on momentum shifts.

2. Breakout Trading

Breakout trading focuses on identifying key support and resistance levels. Traders enter positions when the price breaks through these levels, expecting significant movements.

3. Range Trading

This strategy involves identifying price ranges and trading within those ranges. Traders buy at support levels and sell at resistance levels, capitalizing on price oscillations.

Common Mistakes to Avoid

While making predictions, traders often fall into common traps. Avoiding these mistakes can enhance the accuracy of Pocket Option predictions:

- Ignoring Market Sentiment: Understanding market psychology is as important as technical analysis.

- Overtrading: Engaging in too many trades can lead to losses due to emotional decision-making.

- Neglecting Risk Management: Failing to implement proper risk management strategies can result in severe losses.

Conclusion

Making accurate Pocket Option predictions is an ongoing process that involves continuous learning, market analysis, and strategic planning. By utilizing technical analysis, understanding market trends, and avoiding common trading pitfalls, traders can significantly enhance their chances of trading success. Whether you are a novice or an experienced trader, the key to thriving in the trading world is to stay informed, remain disciplined, and continually refine your strategies.